Transparent Pricing

We don't hide pricing behind calls or meetings. Clear numbers upfront.

8×20 Single Door

Standard option

Starting from

$2,800 each

- 160 sq ft ($17.50/sq ft)

- Single door on end

- Roll-up or standard doors

- Professional installation available

- Flat-pack shipping (14 units/container)

- Up to 10-year warranty

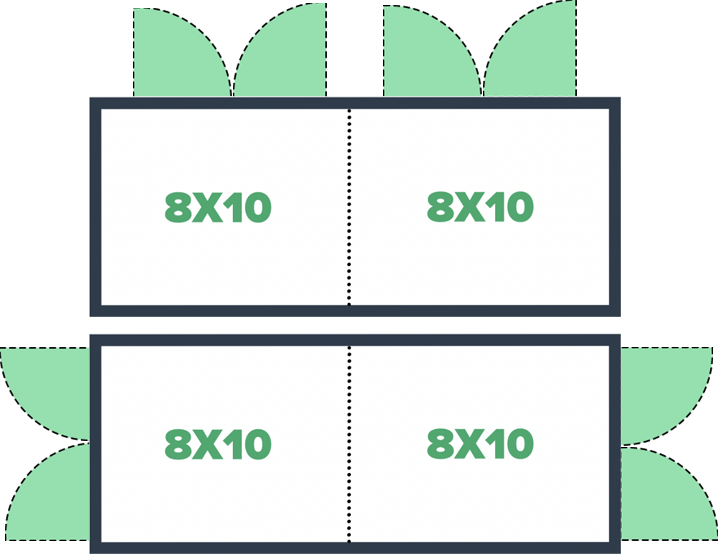

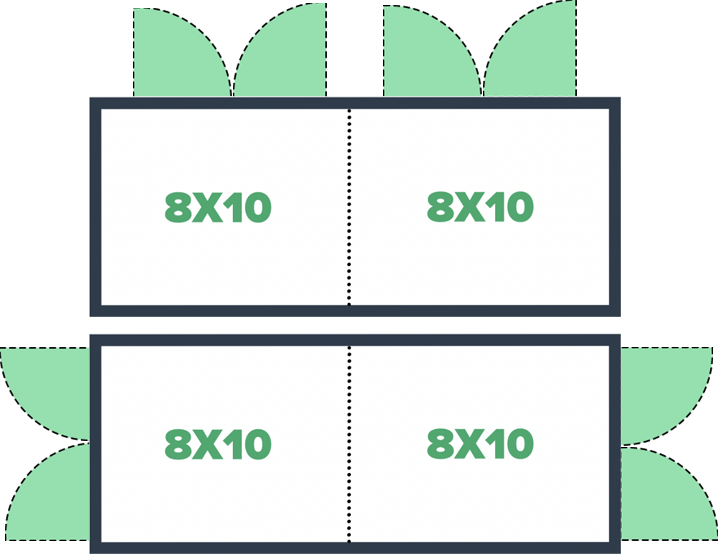

8×20 Double Door

Most popular choice

Starting from

$3,200 each

- 160 sq ft ($20/sq ft)

- Flexible door placement options

- Roll-up or swing-open doors

- Perfect for high-traffic units

- Dual access convenience

- Maximum accessibility

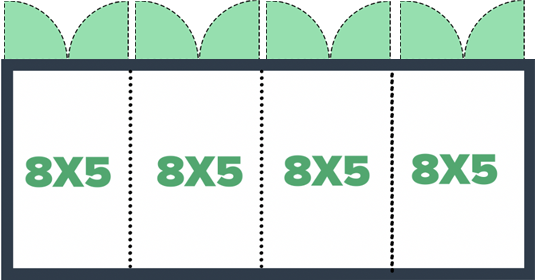

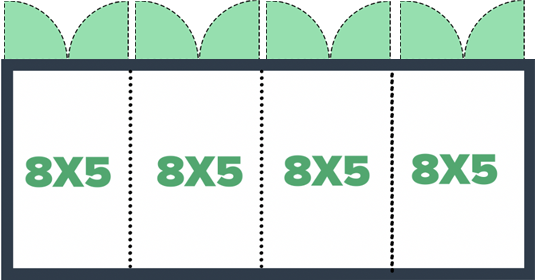

4-Unit Container

Maximum density

Starting from

$4,000 each

- 4 units of 40 sq ft each

- $25/sq ft total

- Individual doors per unit

- Maximizes rental income

- Perfect for smaller storage needs

- Higher revenue per container

Full Service, Full Transparency

📦

Shipping Estimate

$7,000-$8,000

Per 40' High Cube container (14 units each). Dependent on market conditions and subject to change

🚚

Logistics Support

Dedicated Team

Personal coordinator manages all shipping at carrier cost—no markup. From order placement to site delivery

📋

Quote Process

All-Inclusive

Exact pricing before you order—no surprises

💳

Financing Help

Full Support

We guide you through financing options and applications

Quote Builder

Quote Builder

| Quantity | Container Type & Pricing | Configuration Details | Total Investment | Monthly Rent/Unit | Per Sq Ft |

|---|---|---|---|---|---|

|

8×20 Single Door

i

$2,800 per container

|

1 Unit • 8×20 • 160 sq ft

|

$0 | $1.20 | ||

|

8×20 Double Door

i

$3,200 per container

|

2 Units • 8×10 • 80 sq ft each

|

$0 | $1.25 | ||

|

4-Unit Container

i

$4,000 per container

|

4 Units • 8×5 • 40 sq ft each

|

$0 | $1.50 | ||

|

Subtotal

0 Containers • 0 Units

|

$0 |

0/14 (0 Shipments)

Add 0 containers for full shipment

|

|||

Project Analysis

| Container Type | Quantity | Quantity of Units | Total Sq Ft | Monthly Rent | Annual Rent |

|---|---|---|---|---|---|

| 8×20 Single Door | 0 | 0 | 0 sq ft | $0 | $0 |

| 8×20 Double Door (2 units) | 0 | 0 | 0 sq ft | $0 | $0 |

| 4-Unit Container (4 units) | 0 | 0 | 0 sq ft | $0 | $0 |

| Total | 0 | 0 | 0 sq ft | $0 | $0 |

Included with Every Unit:

✓

Diamond Pattern Treadplate Flooring

✓

Color Matching on All Units

✓

Interior Divider Walls

✓

All Mounting Hardware Included

Shipping Details (estimate)

Click to view breakdown

$0 - $0

▼

| Shipping Type | Details | Rate | Total Cost |

|---|---|---|---|

|

Overseas Shipping

0 shipments

|

Per 40' High Cube

Each contains 14 units

|

$

to

$

|

$0 |

|

Inland Shipping

0 shipments

|

$

to

$

/mi/ship

|

$0 | |

| Total Shipping | Overseas + Inland | Range estimate | $0 |

This is an estimate and may vary wildly. Final shipping quote will be emailed once order is booked.

Assembly Options

Choose your preferred assembly method

$0

▼

Assembly service includes complete setup and installation. Pricing is per container regardless of unit configuration.

Financing Fee (optional)

PO funding option available

$0

▼

PO Funding Service: If your financing partner requires units to arrive before funding, ContainerHQ offers a 5% PO funding fee based on unit cost. This allows us to place your order immediately and gives you flexibility for your financing options, subject to conditions and ContainerHQ approval.

Duties and Tariffs (estimate)

$0

▼

| Fee Type | Rate | Base Amount | Total Cost |

|---|---|---|---|

|

Tariff 9903.01.24

i

Section 301 Tariff

Additional tariff on Chinese goods under Section 301 of the Trade Act. Applies to storage containers and related products.

Section 301 Tariff

|

%

|

$0 | $0 |

|

Tariff 9903.01.25

i

Section 301 Tariff

Lower rate Section 301 tariff for certain Chinese imports. Alternative classification for storage container products.

Section 301 Tariff

|

%

|

$0 | $0 |

|

Harbor Maintenance Fee (HMF)

i

Harbor Maintenance Fee

Fee to fund maintenance and improvement of U.S. harbors and waterways. Applied at 0.125% of cargo value.

0.125% of cargo value

|

%

|

$0 | $0 |

|

Merchandise Processing Fee (MPF)

i

Merchandise Processing Fee

Fee for processing imports through U.S. Customs. Calculated at 0.3464% of cargo value with minimum $33.58, maximum $651.50.

0.3464% (min $33.58, max $651.50)

|

%

|

$0 | $0 |

|

Import Duty

i

Canadian Import Duty

Standard Canadian duty rate on imported goods. Applied to the customs value of storage containers.

Standard duty rate

|

%

|

$0 | $0 |

|

GST/HST

i

Goods and Services Tax

Canadian federal tax on imports. Rate varies by province (5% GST or 13-15% HST).

GST/HST rate

|

%

|

$0 | $0 |

|

Processing Fee

i

Broker Processing Fee

Customs broker fee for handling import documentation and clearance procedures.

Per shipment

|

$

|

0 shipments | $0 |

| Total Duties & Tariffs | Estimated total | $0 | |

Tariff and duty rates change frequently. These are estimates based on current rates and may vary.

Sales Tax (estimate)

Click to view breakdown

$0

▼

| Tax Type | Rate | Taxable Amount | Total |

|---|---|---|---|

| State Sales Tax |

%

|

$0 | $0 |

| Local Tax |

%

|

$0 | $0 |

| Total Sales Tax | Combined tax | $0 | |

Investment Summary

Complete project analysis and financial projections

Total Investment Required

$0

UNITS

$0

SHIPPING

$0

DUTIES

$0

TAXES

$0

ASSEMBLY

$0

FINANCING

$0

Revenue Projections

Monthly Revenue

$0

Annual Revenue

$0

Performance Metrics

Return on Investment

0%

Payback Period

-- months

Project Specifications

CONTAINERS

0

RENTAL UNITS

0

SQUARE FOOTAGE

0 sq ft

SHIPMENTS

0

EXPORT PDF

EXPORT PNG

Construction Cost Analysis

See how ContainerHQ stacks up against traditional construction methods

✅ ContainerHQ Modular Storage

Ready in weeks, not months • Fast installation

$17.50-$25.00

per sq ft

Excludes shipping, delivery & taxes

❌ Single-Story Traditional Construction

3-5x more expensive

$50-$85

per sq ft

❌ Multi-Story Traditional Construction

5-7x more expensive

$90-$130

per sq ft

❌ Climate Controlled Traditional

3-4x more expensive

$50-$75

per sq ft